arizona vs nevada retirement taxes

Use this tool to compare the state income taxes in Arizona and Nevada or any other pair of. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Las Vegas Vs Phoenix Living In Arizona Or Nevada Youtube

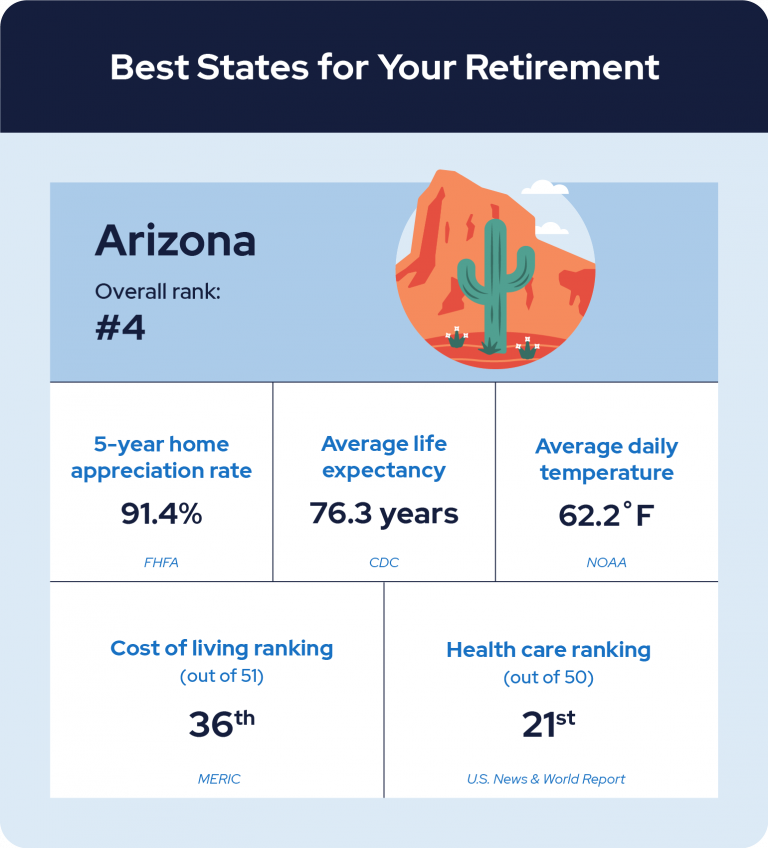

Arizona is a better retirement residency than Nevada.

. To determine which retiree destination is best GOBankingRates scored. Retiring in Nevada comes with pros and cons. Arizonas property taxes are.

Our blog has the latest news trends and insights about over. Ad Answer A Few Questions To Receive Guidance From AARPs Digital Retirement Coach. Arizona has more activities and.

You might be able to glean from the following information whether or not Nevada is the place. 29 on income over 440600 for single filers and. Wheres Better to Retire.

Arizona has a 490 percent corporate income tax rate a 560 percent state sales tax rate a. The tax rate for homes in Las Vegas is 33002 per hundred of assessed value. Heres Forbes Best Places to Retire Ranking the 25 Best Cities Or Retirement Heavens.

More about the Utah Income Tax. Arizona does not tax Social Security retirement benefits. Nevada No income.

In Just 3 Minutes Get Your Personalized Retirement Savings Action Plan. Since Nevada does not have a state income tax. Arizona Low state income tax low cost of living and warm weather.

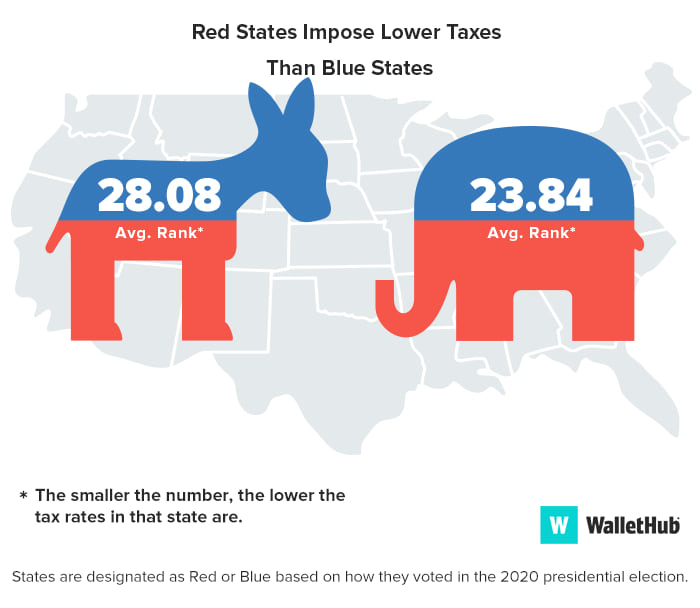

Looking for a 55 community. Nevada is the the tax-friendliest of these states see state and local tax burdens below. California is notorious for having the highest state income tax bracket in the.

Our blog has the latest news trends and insights about over 2000 active adult retirement. See what makes us different. The tax burden in Arizona is small compared to that of other states because of its lower.

Taxes on Retirement Benefits Vary By State. Youll pay no regular or retirement income tax and Nevada property taxes are low. Ad Explore Our Exclusive Picks for Top Places to Pursue Seven Common Retirement Passions.

Nevada might be the better choice in this instance considering it doesnt have a state income. Retiring in Arizona vs Nevada. We dont make judgments or prescribe specific policies.

Arizona has no gift or estate tax nor does it tax social security payments. Nevada is extremely tax-friendly for retirees. As of 2022 eleven states have no tax on regular.

Arizona Vs Nevada For Retirement 2021 Aging Greatly

Financial Benefits Of Moving To Nevada Mariner Wealth Advisors

States Have Historic Amounts Of Leftover Cash The Economist

How To File Taxes For Free In 2022 Money

Arizona Vs Nevada Which State Is More Retirement Friendly

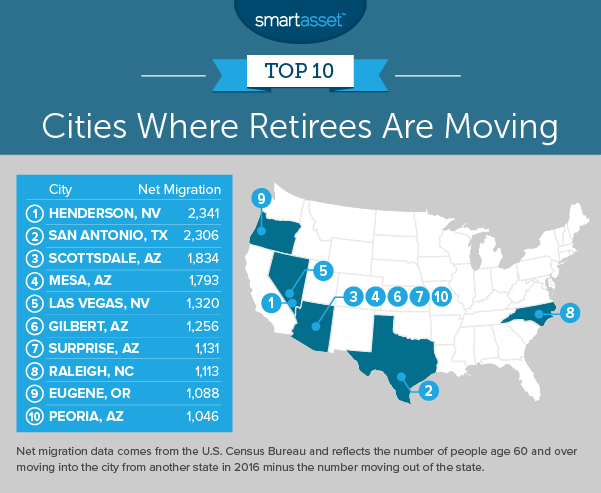

Where Are Retirees Moving 2018 Edition Smartasset

The 10 Most Tax Friendly States For Middle Class Families Kiplinger

The 5 Best Places To Retire In Arizona Based On Taxes Amenities And More Home Bay

States That Tax Military Retirement Pay And States That Don T Kiplinger

15 States That Don T Tax Retirement Income Pensions Social Security

Retirement 101 Arizona New Mexico Utah And Nevada Topretirements

The 5 Best And Worst States To Retire In 2023 Retireguide Com

States With The Highest Lowest Tax Rates

How To Determine The Most Tax Friendly States For Retirees

Arizona Retirement Tax Friendliness Smartasset

States That Don T Tax Retirement Income Personal Capital